The Best Strategy To Use For Feie Calculator

Getting My Feie Calculator To Work

Table of ContentsThe 5-Minute Rule for Feie CalculatorThe Of Feie CalculatorFeie Calculator Fundamentals ExplainedThe 8-Minute Rule for Feie CalculatorFeie Calculator - Truths

United States expats aren't limited just to expat-specific tax breaks. Commonly, they can declare a number of the very same tax credit histories and deductions as they would in the US, including the Youngster Tax Obligation Credit Score (CTC) and the Life Time Discovering Credit Report (LLC). It's possible for the FEIE to decrease your AGI a lot that you don't receive certain tax obligation credit histories, though, so you'll require to verify your qualification.

The tax code claims that if you're a united state citizen or a resident alien of the USA and you live abroad, the internal revenue service tax obligations your worldwide income. You make it, they tire it despite where you make it. You do obtain a good exemption for tax year 2024 - Foreign Earned Income Exclusion.

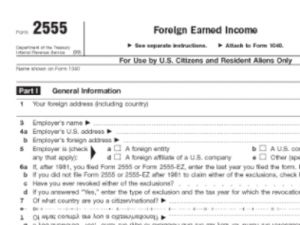

For 2024, the maximum exclusion has been boosted to $126,500. There is likewise an amount of professional real estate expenditures eligible for exemption. Normally, the optimum quantity of housing costs is limited to $37,950 for 2024. For such calculation, you need to establish your base housing quantity (line 32 of Kind 2555 (https://feiecalcu.carrd.co/)) which is $55.30 daily ($20,240 annually) for 2024, increased by the variety of days in your certifying period that drop within your tax obligation year.

Feie Calculator for Dummies

You'll need to figure the exemption first, because it's restricted to your foreign gained income minus any kind of international real estate exemption you declare. To get the foreign earned income exclusion, the foreign real estate exclusion or the international real estate deduction, your tax home need to remain in a foreign nation, and you must be just one of the following: An authentic resident of an international country for an uninterrupted duration that includes an entire tax year (Authentic Local Examination).

If you proclaim to the international government that you are not a homeowner, the examination is not pleased. Qualification for the exclusion can additionally be influenced by some tax treaties.

For united state residents living abroad or gaining revenue from foreign resources, concerns often develop on just how the united state tax obligation system puts on them and how they can make sure conformity while decreasing tax obligation. From recognizing what international earnings is useful site to browsing various tax return and reductions, it is necessary for accounting professionals to understand the ins and outs of united state

Jump to International revenue is defined as any type of revenue made from resources beyond the USA. It incorporates a large range of financial tasks, consisting of yet not restricted to: Wages and wages gained while functioning abroad Benefits, allocations, and benefits offered by foreign companies Self-employment income stemmed from international businesses Passion made from foreign savings account or bonds Returns from foreign firms Funding gains from the sale of international properties, such as genuine estate or stocks Incomes from leasing out international properties Income produced by foreign organizations or partnerships in which you have a passion Any kind of other revenue earned from international resources, such as nobilities, alimony, or gambling profits International gained income is defined as income earned via labor or solutions while living and functioning in an international country.

It's vital to distinguish international gained earnings from various other kinds of international revenue, as the Foreign Earned Revenue Exemption (FEIE), an important united state tax obligation advantage, specifically applies to this group. Financial investment revenue, rental revenue, and easy earnings from international sources do not qualify for the FEIE - Physical Presence Test for FEIE. These types of revenue may undergo different tax obligation therapy

resident alien who is a person or national of a nation with which the USA has an earnings tax obligation treaty basically and that is an authentic homeowner of a foreign nation or nations for a nonstop period that includes a whole tax year, or An U.S. citizen or a UNITED STATE

The Definitive Guide to Feie Calculator

Foreign gained income. You need to have made revenue from employment or self-employment in an international nation. Passive earnings, such as passion, dividends, and rental earnings, does not certify for the FEIE. Tax obligation home. You need to have a tax obligation home in an international nation. Your tax obligation home is normally the area where you perform your normal service tasks and keep your main economic interests.

tax obligation return for international earnings taxes paid to a foreign government. This credit scores can offset your united state tax obligation on international income that is not qualified for the FEIE, such as investment earnings or easy income. To claim these, you'll first have to certify (Physical Presence Test for FEIE). If you do, you'll then submit additional tax obligation types (Form 2555 for the FEIE and Type 1116 for the FTC) and connect them to Type 1040.

How Feie Calculator can Save You Time, Stress, and Money.

The Foreign Earned Income Exclusion (FEIE) permits eligible people to omit a section of their international gained income from united state tax. This exemption can dramatically reduce or remove the united state tax obligation liability on foreign revenue. Nonetheless, the specific quantity of foreign income that is tax-free in the U.S. under the FEIE can change every year because of rising cost of living adjustments.